are donations to politicians tax deductible

IR-2022-52 March 8 2022. Montana offers a tax deduction.

Are Political Contributions Tax Deductible Personal Capital

The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations.

. No political contributions are not tax-deductible. This applies to a wide range of things associated with politics including political candidates and parties political action committees PACs campaign committees advertisements in convention bulletins and admission to dinners or events that benefit a political candidate or party. Federal political contributions are donations that were made to a registered federal political party or a candidate for election to the House of Commons.

170 c 1 defines charitable contribution which is tax deductible to include a contribution or gift to or for the use of. Whether a political contribution is made in the form of money or a donation in kind it is not tax deductible. The answer is simple No.

You need to claim your tax deduction for a political contribution or gift in the income year you made the contribution or gift. WASHINGTON The Internal Revenue Service reminds taxpayers they may be able to claim a deduction on their 2021 tax return for contributions to their Individual Retirement Arrangement IRA made through April 18 2022. Political contributions are not tax deductible though.

If youre planning to donate money time or effort to a political campaign you might be thinking to yourself Are political contributions tax-deductible No. Donations to this entity are not tax deductible though. An IRA is a personal savings plan that lets employees and the self-employed set money aside for retirement and.

You are not allowed to deduct political contributions from your taxes according to the IRS. However in-kind donations of property to eligible charities may be deductible in the same way as cash donations. Individuals cannot deduct contributions made to political campaigns on their federal tax returns regardless of whether they itemize or claim the standard deduction.

This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible. Businesses likewise cannot claim a deduction for political contributions whether theyre pass-through entities or file a corporate return. The most you can claim in an income year is.

1500 for contributions and gifts to political parties. You can receive up to 75 percent of your first 400 of donation as credit followed by 50 percent of any amount between 400 and 750 and 333 percent of amounts over 750. The short answer.

Reuters is the first to measure the loophole which offers political parties and in some cases individual politicians or their families an unintended gift from the taxpayer. Generally donations to these entities are used for advocacy but not direct electoral purposes where youre asking someone to support or oppose an issue. In fact the IRS specifically calls out political donations as something you cant take as a charitable deduction on your federal return.

When it comes time to file taxes though many people are surprised to learn what qualifies as a tax deduction. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes. Individuals can contribute up to 2800 per election to the campaign committee up to 5000 per year for PAC and up to 10000 per year for local or district party committees.

Political contributions deductible status is a myth. Are Political Donations Tax Deductible. The contribution to the political party should not be made in cash or kind.

Thats because political parties organizations and candidates arent considered charities referred to as qualifying organizations for purposes of federal income taxes. This amendment to the Section was brought into effect from the financial year 2013-14 onwards. Americans are encouraged to donate to political campaigns political parties and other groups that influence the political landscape.

If you decided to donate money or time or effort to political campaign you might wonder whether political contributions that you make are tax deductible. Political donations made by individuals are not tax-deductible in Britain. Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost.

As of 2020 four states have provisions for dealing with political contributions. The simple answer to whether or not political donations are tax deductible is no. A State a possession of the United States or any political.

Taxation is very clear about it since contributions to politicians or political parties cannot be deducted from your income. 1500 for contributions and gifts to independent candidates and members. Simply put political contributions are not tax deductible.

Contributions donations or payments made for political candidates cannot be deducted from your taxable income. If you support your favorite candidate you might be. Below we provide a list that IRS says is not tax deductible.

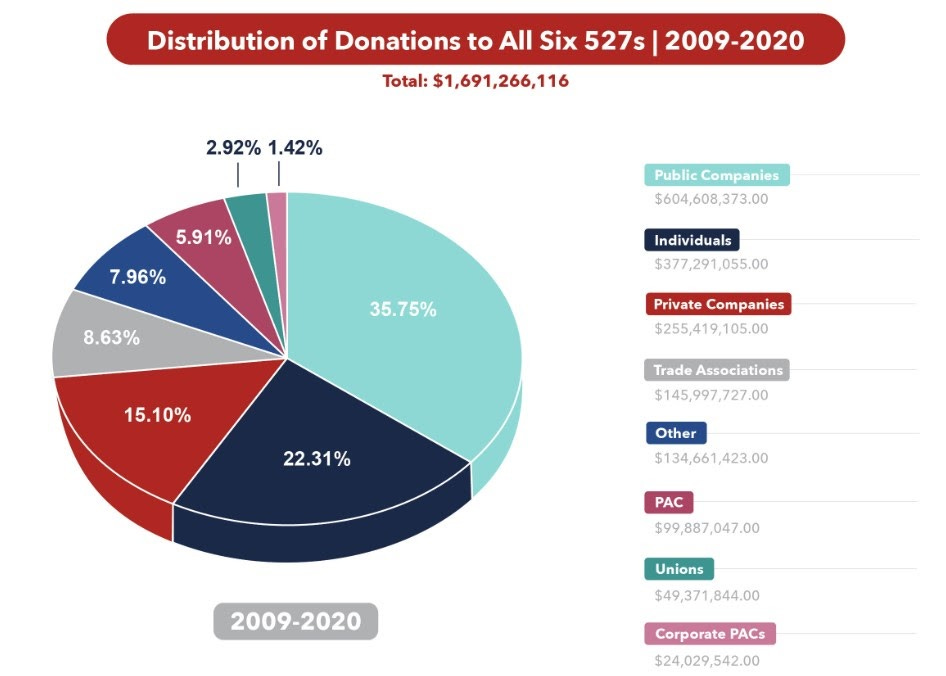

Until 2006 100 in political donations could be claimed as a tax deduction for income tax purposes. A 527 entity is a political organization. Millions of pounds in donations to political parties a Reuters analysis has found.

A contribution donation or payment made as a contribution to contribution donations or payments for any of these that amount cant be deducted from your taxes. The IRS tells clear that all money or effort time contributions to political campaigns are not tax deductible. In most cases yes.

A gift to a local government entity is tax deductible if it is solely for public purposes The IRS Code at 26 USC. Some political organizations are considered independent expenditure. The answer to the question Are political donations tax-deductible is simply No May the entity be an individual a business or a corporation all kinds of political donations come under those opted purely by choice and hence can not be recognized as tax-deductible as per IRS rules and regulations.

Although political contributions are not tax-deductible there is always a limit to the amount that can be contributed to a political campaign. Donations or contributions made in cash or kind are not eligible for tax deductions.

Funding Of Political Parties And Election Campaigns

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace

During The 3rd And Final Presidential Debate Killary Confirmed That She Agreed With A Woman S Choice To Abort A Ba Trump Make America Great Again Pinte

Disruption A Battle For The Future Of Food Etc Group

The Complete Political Fundraising 2022 Guide With Ideas Numero Blog

1 Billion In Gifts Attracts New Attention To The Rules On Charities And Political Giving

It S Not Too Late To Support Giving Tuesday Support A Youth Shooting Team Of Your Choice Giving Tuesday Supportive Youth

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Opinion Of Course Campaign Donations For Kennedy Stewart Cannot Be Claimed On Your Tax Return Vancouver Is Awesome

How Corporations Give Republicans A Massive Financial Advantage In State Politics

The Truth About Political Donations There Is So Much We Don T Know

Charity Navigator Top 5 Things To Remember When Making Political Donations

The Dodo On Twitter Watch This Plain Little Caterpillar Transform Caterpillar Macro Photos Luna Moth

Federal And California Political Donation Limitations Seiler Llp

How Corporations Disguise Lobbying As Philanthropy The Brink Boston University

Limiting Secret Money In Politics Crew Citizens For Responsibility And Ethics In Washington

1 Billion In Gifts Attracts New Attention To The Rules On Charities And Political Giving